Turn Climate Risk into strategic insight.

Our data-driven platform delivers quantitative, company specific and scenario-driven insights linking climate transition pathways to financial performance.

Helping financial institutions manage risks and opportunities, align strategies, and strengthen climate resilience—fully compliant with EU requirements.

Transition funds

Identify alpha opportunities, transition leaders, assess portfolio alignment with climate targets, and support engagement efforts.

Sustainability leadership

Assess alignment of internal and client transition plans with Paris Agreement and regulatory targets, identify financial risks of misalignment, and drive cross-bank sustainability efforts.

Sustainable debt markets

Structure and advise clients on sustainable finance products, identify financing opportunities, validate credibility of transition plans, and translate climate risk into financial terms.

Credit risk

Counterparty-specific transition risk assessments, identification of stranded assets, and financial impacts of transition.

Climate resilience analysis

Avoid risk of SREPSupervisory Review and Evaluation Process score downgrading. Full NGFSNetworking for the Green Financial System-based scenario integration, forward-looking resilience analysis for ICAAPInternal Capital Adequacy Assessment Process, ILAAPInternal Liquidity Assessment Assessment Process, and improved SREPSupervisory Review and Evaluation Process scores.

We've got you covered!

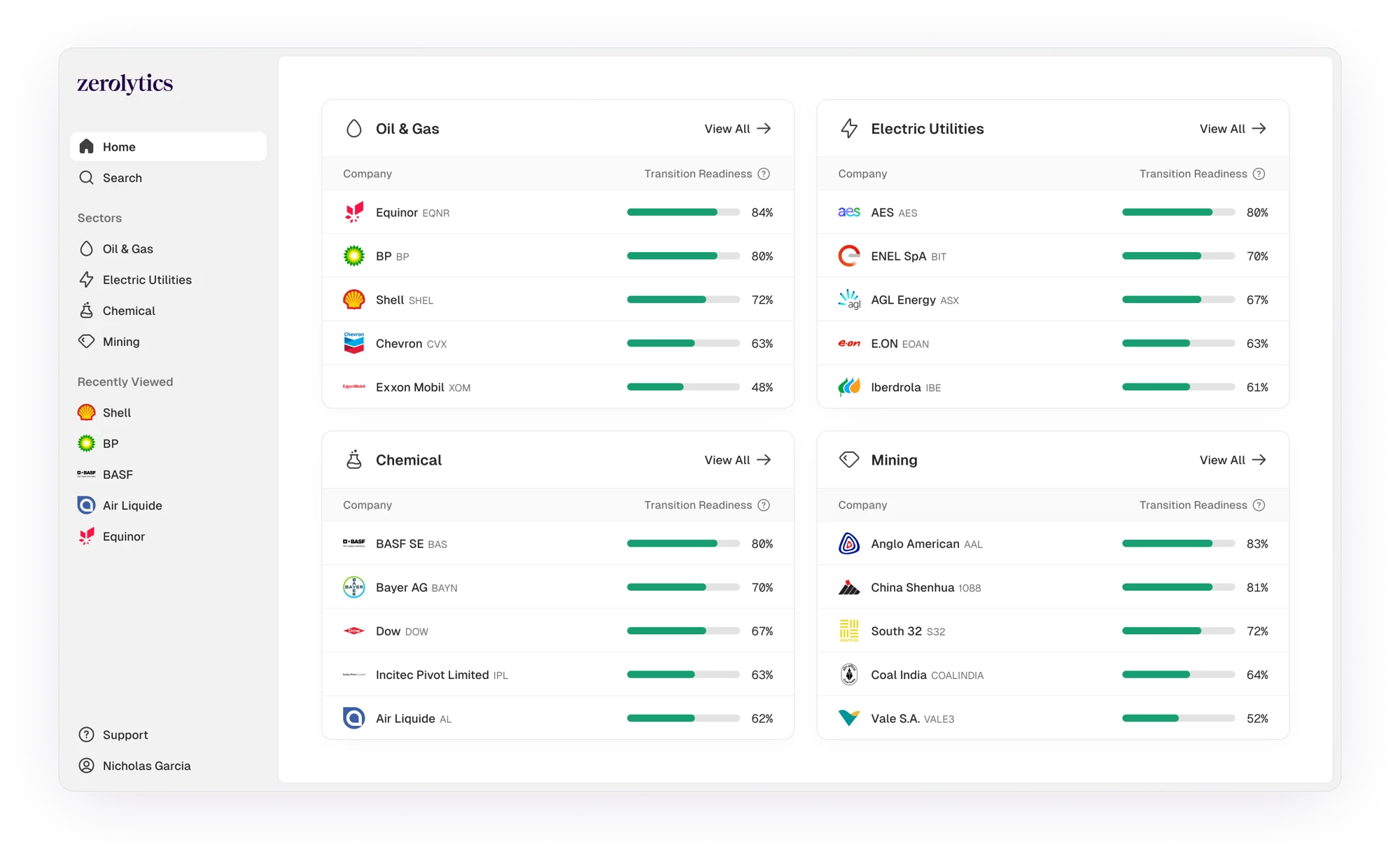

With hundreds of models across 15+ industries and rapid on-demand creation, we ensure seamless coverage for your needs. Any company, any industry, any time.

For illustration purposes only. Actual figures are updated within the platform.

Is your climate risk strategy ready for EBA/GL/2025/01?

Regulatory compliance

Fully EBA/GL/2025/01 compliant. Avoid downgrading SREPSupervisory Review and Evaluation Process score and reduce capital requirements.

Robust benchmarking

Manage risk and uncover new opportunities with our advanced data platform.

Reduce costs — save time

Automate your quantitative assessments of transition plans.

Answering five key questions

- Are companies' climate targets credible and ambitious?

- Are CapEx plans and strategy aligned with a Net Zero pathway?

- How do external factors impact target achievement?

- What are the financial implications of reaching climate targets?

- How does a company's performance compare to industry peers?

Frequently asked questions

What makes Zerolytics different from other sustainability assessment tools on the market?

+

How difficult is it to integrate Zerolytics into our existing processes?

+

What is a financial digital twin?

+